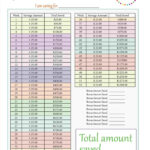

Free Get Out Of Debt Spreadsheet Inside Get Out Of Debt Budget

Get Out Of Debt Budget Worksheet

Get Out Of Debt Budget Worksheet – A Budgeting Worksheet is a form of a budget that reveals what you spent throughout each month and assists you prepare for the next month’s investing. You can download a budgeting worksheet here. You can utilize this to plan your monthly spending and also track your progression as you go. You can likewise print out a budget plan worksheet as well as utilize it for intending objectives.

What are Budgeting Worksheets?

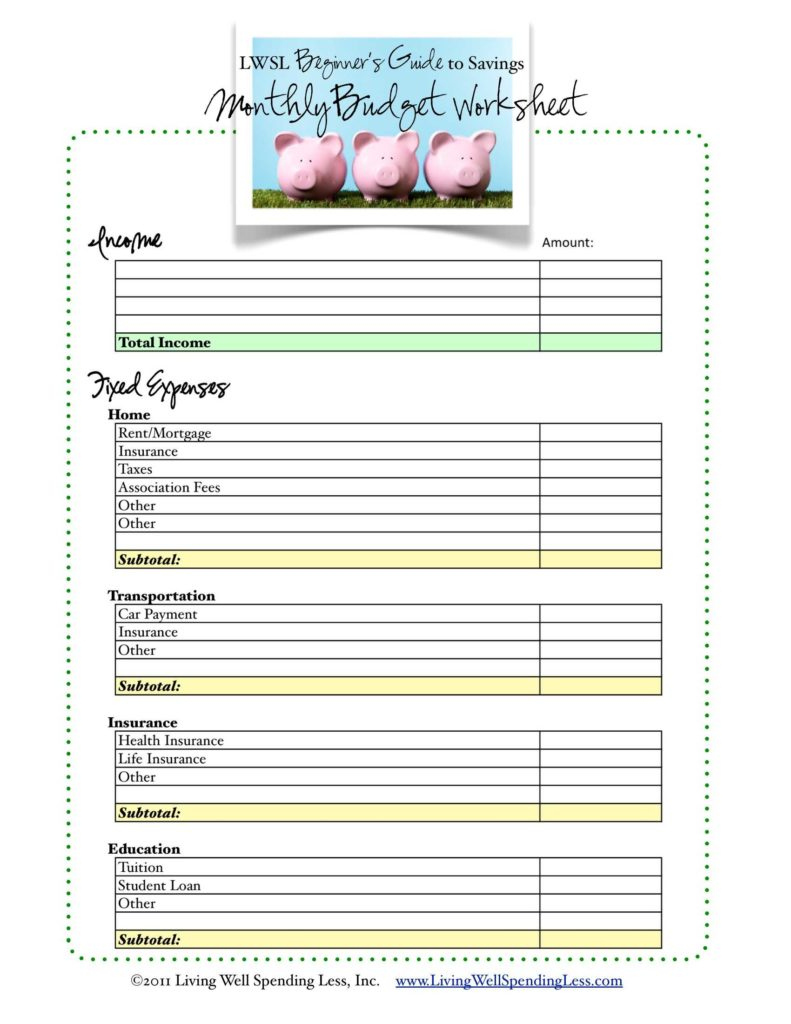

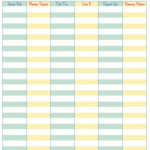

Budgeting worksheets can be made use of to make sure you remain within your spending plan. These worksheets help you identify which expenses are unnecessary and which are essential. They usually have classifications for revenue, real estate, as well as energies. These groups can aid you figure out what you require to conserve or invest, and just how much you can afford to invest. A typical budget plan worksheet consists of columns for each and every group. The income column would include your income, suggestions, and also other sources of income. The expenses column would include your residence’s mortgage or lease repayment, family insurance policy, and repairs and also upkeep. Various other expenditures in a monthly spending plan consist of energy costs, such as gas, water, as well as Internet bills.

There are numerous cost-free online budgeting worksheets. One such theme is supplied by My Frugal Home. You can load it out and also print it out to start planning your finances. The worksheets ask inquiries about your investing habits, which will certainly aid you find out locations where you can cut back and increase your earnings.

Why is a Budgeting Worksheets Important?

A budgeting worksheet can aid you to stay on track with your costs. It assists you track all your prepared savings as well as expenses. By doing this, you can see where your cash is going and whether you can cut down. In addition, a budgeting worksheet assists you see where you have an excess of cash to conserve or invest. You can use a spread sheet program like Excel to do this. A spread sheet can likewise aid you keep an eye on your spending behaviors and track your income and expenses.

Utilizing a budgeting worksheet is very important to see where your money goes monthly. It will show you just how much money you are spending on each category. Normal budgeting worksheets are broken down into dealt with and adaptable groups. Fixed costs are things like your rental fee or home mortgage repayment and also revenue from a task. Versatile expenses are those that alter month to month, such as groceries and enjoyment. If you have changing costs, it is a good idea to take a standard over three months.

Get Out Of Debt Budget Worksheet

Get Out Of Debt Plan Spreadsheet With Paying Off Debt Worksheets Db

Free Get Out Of Debt Spreadsheet With Regard To Get Out Of Debt Budget

Get Out Of Debt Budget Spreadsheet Db excel

Get Out Of Debt Budget Worksheet

If you ‘d like Get Out Of Debt Budget Worksheet to make use of in developing a budget, you can locate lots of readily available online. Some internet sites use budgeting worksheets free of cost, while others provide even more pricey and also fancy tools. Mint is just one of one of the most popular budgeting applications, as well as has cost-free printable budgeting worksheets.

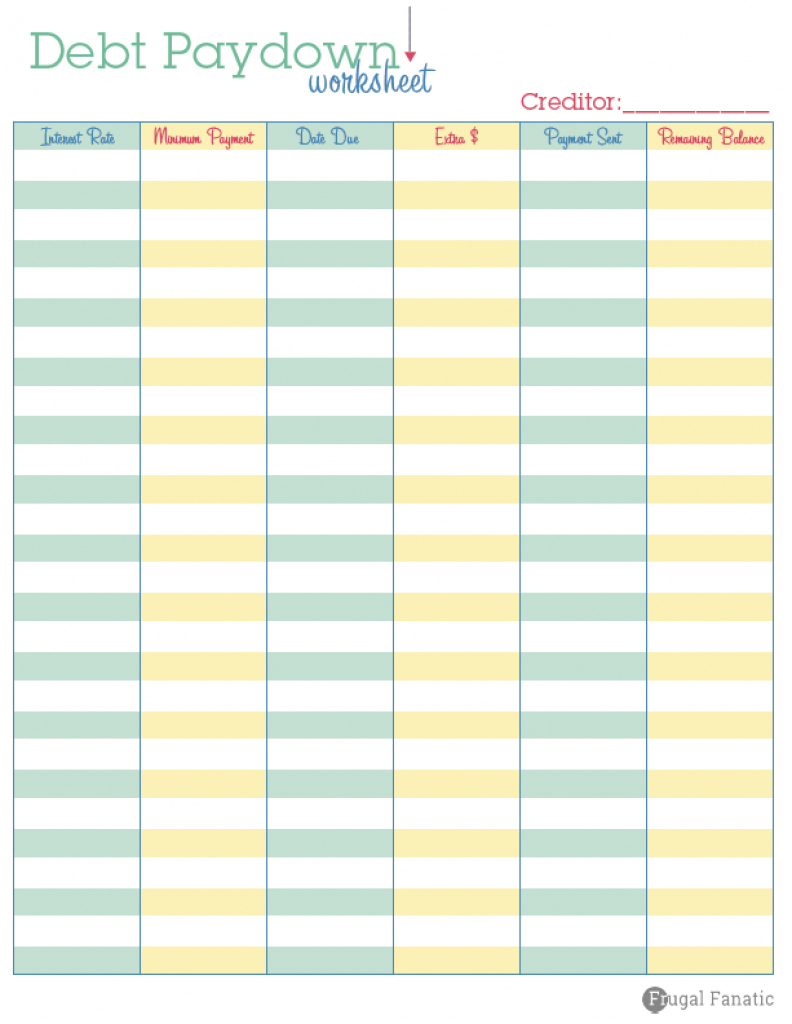

The Frugal Fanatic Worksheet is a basic, clean-looking budget plan that can be printed and also saved to assist you prepare your regular monthly expenditures. Budgeting can be daunting, and also a budgeting worksheet can assist keep you on course. This easy template allows you to track your savings, earnings, as well as dealt with and variable expenses every month. It likewise consists of an area to prepare for your future and set goals.

If you’re just starting with budgeting, a complimentary budgeting worksheet will help you remain organized and also on course with your funds. Whether you want to track your expenditures for day-to-day living, unique occasions, or both, these worksheets can aid you maximize your money and also avoid of debt.