Budgeting Worksheets | Medical Student Budget Worksheet – Being a medical student is both a rewarding and challenging journey. While you are busy studying to become a healer, it is important to also focus on managing your finances wisely. Creating a budget worksheet can help you stay on track and ensure that you are not overspending. In this article, we will provide you with some budgeting basics and tips on how to plan your finances like a pro student doctor.

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/blank-budget-template-e289a1-fill-out-printable-pdf-forms-online-within-medical-student-budget-worksheet.webp” alt=”Blank Budget Template ≡ Fill Out Printable Pdf Forms Online within Medical Student Budget Worksheet”]

Budgeting Basics for Future Healers

First and foremost, it is important to track your income and expenses. Start by listing all your sources of income, including student loans, scholarships, part-time jobs, and any other financial aid you may receive. Next, list all your expenses, such as tuition fees, textbooks, rent, utilities, groceries, transportation, and any other necessary expenses. Once you have a clear picture of your income and expenses, you can create a budget plan that works for you.

Additionally, it is crucial to differentiate between needs and wants. While it is important to prioritize your education and health, it is also okay to treat yourself occasionally. However, make sure that your wants do not exceed your budget. Look for ways to cut costs, such as cooking at home instead of eating out, carpooling or using public transportation instead of driving, and buying used textbooks or borrowing them from the library. By being mindful of your spending habits, you can save money for emergencies or unexpected expenses.

Lastly, don’t forget to review and adjust your budget regularly. Your financial situation may change over time, so it is important to reassess your budget and make any necessary adjustments. Keep track of your spending and check in with your budget worksheet weekly or monthly. By staying organized and proactive with your finances, you can avoid unnecessary stress and focus on your studies and future career as a healer.

Plan Your Finances Like a Pro Student Doc

As a future healer, it is important to plan your finances like a pro student doctor. Start by setting financial goals for yourself, such as paying off student loans, saving for a residency program, or investing in your future practice. Create a budget plan that aligns with your goals and helps you achieve financial success. Allocate a portion of your income towards savings, emergency funds, and retirement planning.

Furthermore, consider seeking financial advice from professionals or taking advantage of resources available to medical students, such as financial aid workshops or budgeting tools. Use technology to your advantage by downloading budgeting apps or using spreadsheets to track your expenses and monitor your progress. Set reminders for bill payments and stay organized with your paperwork to avoid any financial mishaps.

Being a thrifty future healer is all about being mindful of your finances and planning ahead. By creating a budget worksheet, tracking your income and expenses, prioritizing your needs over wants, and seeking financial advice when needed, you can set yourself up for financial success. Remember that managing your finances well not only benefits you in the present but also prepares you for a successful and fulfilling career in the future. Embrace the journey of budgeting like a pro student doc and watch your financial health flourish along with your medical career.

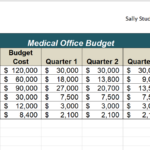

Medical Student Budget Worksheet

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/1-5-chapter-practice-beginning-excel-first-edition-within-medical-student-budget-worksheet.png” alt=”1.5 Chapter Practice – Beginning Excel, First Edition within Medical Student Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/free-8-student-budget-forms-in-pdf-ms-word-pertaining-to-medical-student-budget-worksheet.jpg” alt=”Free 8+ Student Budget Forms In Pdf | Ms Word pertaining to Medical Student Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/hospital-budgeting-template-eloquens-throughout-medical-student-budget-worksheet.jpg” alt=”Hospital Budgeting Template – Eloquens throughout Medical Student Budget Worksheet”]

Budgeting Worksheets…

Copyright Disclaimer: The rights to all images displayed belong to their original owners. Contact us for attribution or removal if necessary.