Budgeting Worksheets | Consumer Credit Counseling Budget Worksheet – Are you ready to take control of your finances and start saving for your future? Consumer credit counseling can be a great resource to help you get on track, but it all starts with a solid budget. By creating a budget worksheet, you can see exactly where your money is going and make adjustments to ensure you are living within your means. This ultimate budget worksheet will help you whip your wallet into shape and set you on the path to financial success.

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/a-survival-budget-spreadsheet-hubpages-with-regard-to-consumer-credit-counseling-budget-worksheet.png” alt=”A Survival Budget Spreadsheet – Hubpages with regard to Consumer Credit Counseling Budget Worksheet”]

Whip Your Wallet into Shape

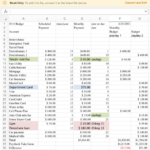

When creating your budget worksheet, start by listing all of your sources of income. This may include your salary, any side gigs, or even passive income from investments. Next, list out all of your expenses, including fixed costs like rent or mortgage payments, utilities, and insurance, as well as variable expenses like groceries, dining out, and entertainment. Don’t forget to also include savings goals and any debt payments you are making. By having a clear picture of your income and expenses, you can make informed decisions about where you can cut back and where you can afford to splurge.

Once you have all of your income and expenses listed on your budget worksheet, it’s time to do some math. Subtract your total expenses from your total income to see if you are living within your means. If you have more expenses than income, it’s time to make some adjustments. Look for areas where you can cut back, whether it’s eating out less often or finding a more affordable place to live. By making small changes to your spending habits, you can start to build a healthy savings account and work towards your financial goals.

Maximize Your Money with This Ultimate Worksheet

Now that you have your budget worksheet in hand, it’s time to start maximizing your money. Look for areas where you can save, whether it’s by cutting back on unnecessary expenses or finding ways to increase your income. Consider creating a separate savings account for emergencies or future goals, and automate your savings to make it easier to stick to your budget. By being intentional with your money and making smart financial decisions, you can set yourself up for long-term success.

Don’t forget to regularly review and update your budget worksheet as your financial situation changes. Life is full of surprises, and unexpected expenses can easily throw off your budget if you’re not prepared. By staying on top of your finances and regularly reassessing your spending habits, you can ensure that you are always in control of your money. Consumer credit counseling can also be a valuable resource to help you stay on track and make adjustments as needed. With the ultimate budget worksheet in hand, you can take charge of your finances and start building a brighter financial future.

Consumer Credit Counseling Budget Worksheet

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/challenge-cash-only-christmas-consumer-credit-in-consumer-credit-counseling-budget-worksheet.jpg” alt=”Challenge: Cash-Only Christmas – Consumer Credit in Consumer Credit Counseling Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/fillable-online-fillable-budget-worksheet-fax-email-print-pdffiller-for-consumer-credit-counseling-budget-worksheet.png” alt=”Fillable Online Fillable Budget Worksheet Fax Email Print – Pdffiller for Consumer Credit Counseling Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/budget-tips-how-to-plan-and-stick-to-a-personal-budget-regarding-consumer-credit-counseling-budget-worksheet.jpg” alt=”Budget Tips | How To Plan And Stick To A Personal Budget regarding Consumer Credit Counseling Budget Worksheet”]

Budgeting Worksheets…

Copyright Disclaimer: The rights to all images displayed belong to their original owners. Contact us for attribution or removal if necessary.