Budgeting Worksheets | Fixed Income Budget Worksheet – Are you tired of living paycheck to paycheck? Are you ready to take control of your financial future and achieve true freedom? It’s time to unleash your financial potential and break free from the constraints of a fixed income budget. With a little bit of planning and discipline, you can start down the path towards financial freedom.

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/10-budget-templates-tools-that-will-change-your-life-for-fixed-income-budget-worksheet.png” alt=”10 Budget Templates & Tools That Will Change Your Life for Fixed Income Budget Worksheet”]

Unleash Your Financial Freedom

The first step towards financial freedom is to take a hard look at your fixed income budget. How much money do you bring in each month, and where does it all go? By creating a detailed budget and tracking your expenses, you can identify areas where you can cut back and save more money. This newfound awareness will give you the power to make better financial decisions and take control of your financial destiny.

Once you have a clear understanding of your income and expenses, it’s time to start setting financial goals. Whether you want to save for a dream vacation, pay off debt, or build an emergency fund, having specific goals in mind will help you stay motivated and focused on your journey to financial freedom. By setting realistic goals and creating a plan to achieve them, you can start making meaningful progress towards a brighter financial future.

Take Control of Your Fixed Income Budget

Now that you have a solid budget in place and clear financial goals to work towards, it’s time to take control of your fixed income budget. One of the keys to success is to live below your means and avoid unnecessary expenses. By cutting back on non-essential items and finding ways to save money, you can free up more cash to put towards your goals and build a more secure financial future.

Another important aspect of mastering your fixed income budget is to prioritize your spending. Make sure to cover your essential expenses first, such as housing, utilities, and groceries, before allocating money towards discretionary items. By focusing on your needs first and making conscious decisions about your spending, you can avoid overspending and stay on track with your financial goals.

Finally, don’t forget to regularly review and adjust your budget as needed. Life is constantly changing, and your financial situation may evolve over time. By revisiting your budget on a regular basis and making adjustments as necessary, you can ensure that you are staying on track towards financial freedom and making the most of your fixed income budget.

Achieving financial freedom is possible for anyone, regardless of their income level. By taking control of your fixed income budget, setting clear financial goals, and making smart financial decisions, you can pave the way towards a more secure and prosperous future. So why wait? Start mastering your fixed income budget today and unlock the door to financial freedom!

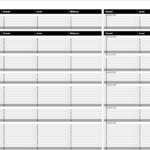

Fixed Income Budget Worksheet

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/free-monthly-budget-templates-for-fixed-income-budget-worksheet.png” alt=”Free Monthly Budget Templates for Fixed Income Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/37-budget-planners-trackers-cute-free-printables-in-fixed-income-budget-worksheet.jpg” alt=”37 Budget Planners & Trackers – Cute & Free Printables in Fixed Income Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/free-and-customizable-budget-templates-intended-for-fixed-income-budget-worksheet.jpg” alt=”Free And Customizable Budget Templates intended for Fixed Income Budget Worksheet”]

Budgeting Worksheets…

Copyright Disclaimer: The rights to all images displayed belong to their original owners. Contact us for attribution or removal if necessary.