Budgeting Worksheets | Retirement Expense Budget Worksheet – Retirement is a time to relax, travel, and enjoy the fruits of your labor. However, in order to truly make the most of your golden years, it’s important to plan ahead financially. Mapping out your retirement finances is a crucial step in ensuring that you have enough savings to live comfortably in your later years. By taking the time to assess your current financial situation and create a budget for your retirement years, you can set yourself up for success and peace of mind.

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/free-personal-expense-worksheet-millennial-wealth-llc-with-retirement-expense-budget-worksheet.png” alt=”Free Personal Expense Worksheet – Millennial Wealth, Llc with Retirement Expense Budget Worksheet”]

Mapping Out Your Retirement Finances

The first step in planning for your golden years is to take stock of your current financial situation. This includes calculating your retirement savings, pension, Social Security benefits, and any other sources of income you may have. Once you have a clear understanding of your financial resources, you can begin to create a budget for your retirement years. Consider factors such as housing expenses, healthcare costs, travel plans, and any other lifestyle choices you may want to make during retirement. By mapping out your finances in advance, you can avoid any surprises and ensure that you have enough savings to cover your expenses.

In addition to creating a budget, it’s important to stay organized and track your expenses throughout your retirement years. This is where a retirement expense tracker comes in handy. By keeping track of your spending habits and adjusting your budget as needed, you can ensure that you are staying on track with your financial goals. A retirement expense tracker can help you identify areas where you may be overspending or where you can cut back in order to save more for the future. By staying ahead with a retirement expense tracker, you can enjoy your golden years with peace of mind knowing that you are financially secure.

Stay Ahead with a Retirement Expense Tracker

As retirement approaches, it’s important to stay proactive and keep track of your expenses to ensure that you are on the right financial path. A retirement expense tracker can help you stay ahead by providing a clear overview of your spending habits and allowing you to make informed decisions about your finances. By regularly updating your expense tracker and reviewing your budget, you can adjust your savings goals and make any necessary changes to your spending habits. With a retirement expense tracker, you can confidently plan for your golden years and enjoy a worry-free retirement.

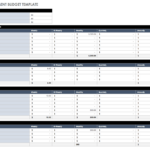

Retirement Expense Budget Worksheet

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/free-monthly-budget-templates-inside-retirement-expense-budget-worksheet.png” alt=”Free Monthly Budget Templates inside Retirement Expense Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/free-retirement-budget-worksheets-guideexamples-in-retirement-expense-budget-worksheet.jpg” alt=”Free Retirement Budget Worksheets | (Guide+Examples) in Retirement Expense Budget Worksheet”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/monthly-retirement-budget-retirement-budget-retirement-planning-with-retirement-expense-budget-worksheet.jpg” alt=”Monthly Retirement Budget, Retirement Budget, Retirement Planning with Retirement Expense Budget Worksheet”]

Budgeting Worksheets…

Copyright Disclaimer: The rights to all images displayed belong to their original owners. Contact us for attribution or removal if necessary.