8 Daily Budget Spread Sheet Template SampleTemplatess SampleTemplatess

Budget Planner Worksheet Download

Budget Planner Worksheet Download – A Budgeting Worksheet is a kind of a budget plan that reveals what you invested during monthly as well as assists you prepare for the following month’s spending. You can download a budgeting worksheet here. You can utilize this to prepare your month-to-month investing as well as track your progress as you go. You can additionally print out a spending plan worksheet and utilize it for planning objectives.

What are Budgeting Worksheets?

Budgeting worksheets can be used to make sure you stay within your spending plan. These worksheets assist you recognize which costs are unnecessary and also which are needed. They normally have categories for income, housing, and also utilities. These groups can aid you find out what you require to spend or conserve, as well as just how much you can pay for to spend. A common budget worksheet consists of columns for every group. The revenue column would certainly include your income, tips, as well as various other resources of earnings. The expenditures column would include your residence’s home mortgage or rent payment, family insurance, as well as repairs and also maintenance. Other expenses in a monthly spending plan consist of energy costs, such as natural gas, water, and Internet costs.

There are a number of complimentary online budgeting worksheets. The worksheets ask inquiries regarding your investing behaviors, which will certainly assist you figure out locations where you can cut back as well as increase your revenue.

Why is a Budgeting Worksheets Important?

A budgeting worksheet can help you to remain on track with your costs. It helps you track all your planned expenses and also financial savings. By doing this, you can see where your cash is going and also whether you can cut back. Additionally, a budgeting worksheet aids you see where you have an excess of cash to save or spend. You can use a spread sheet program like Excel to do this. A spreadsheet can additionally help you track your spending practices as well as track your earnings as well as expenses.

Making use of a budgeting worksheet is essential to see where your money goes every month. It will certainly reveal you how much money you are spending on each category. Regular budgeting worksheets are broken down into dealt with and adaptable groups. Set costs are things like your rent or home mortgage payment as well as revenue from a task. Versatile costs are those that transform month to month, such as grocery stores and also amusement. It is a great concept to take a standard over 3 months if you have fluctuating expenditures.

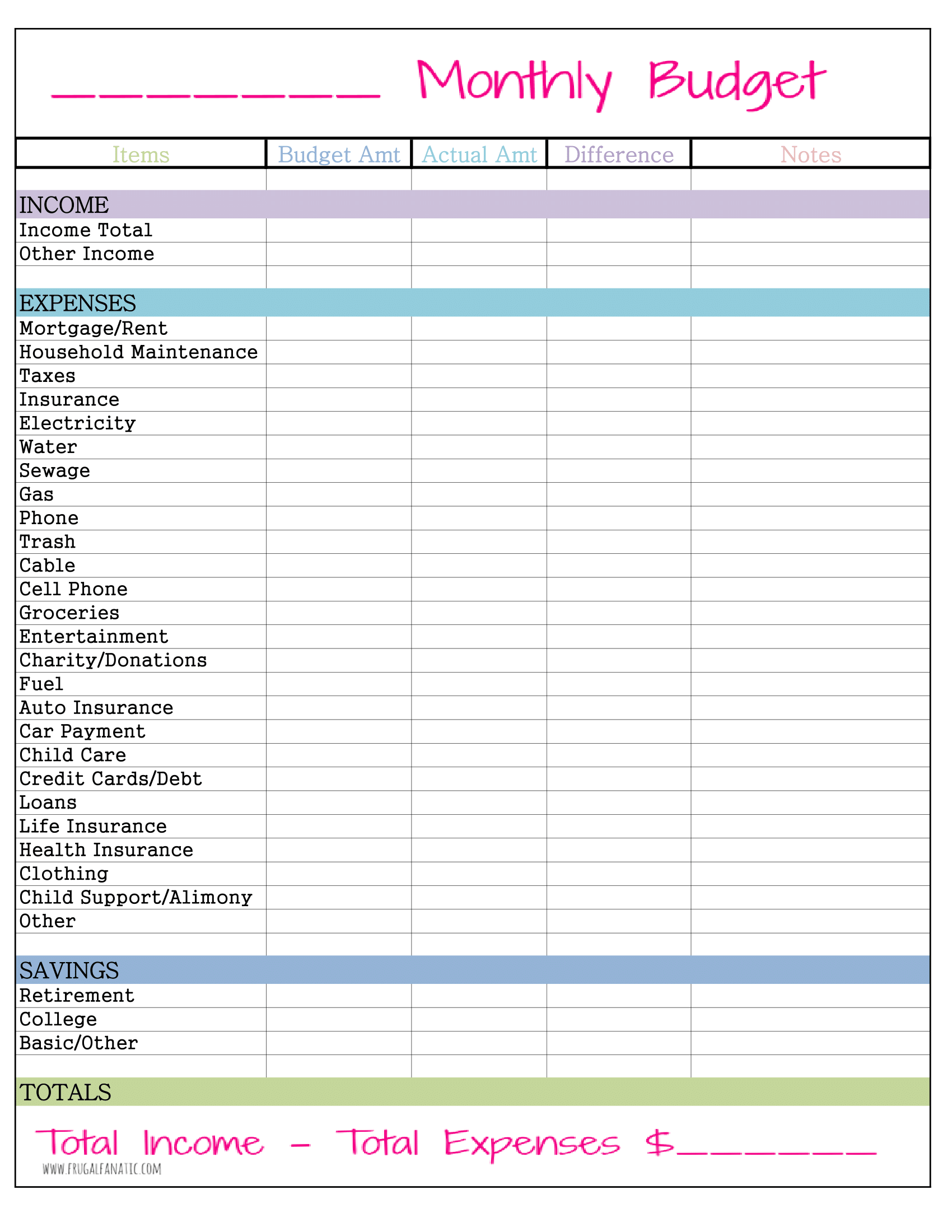

Budget Planner Worksheet Download

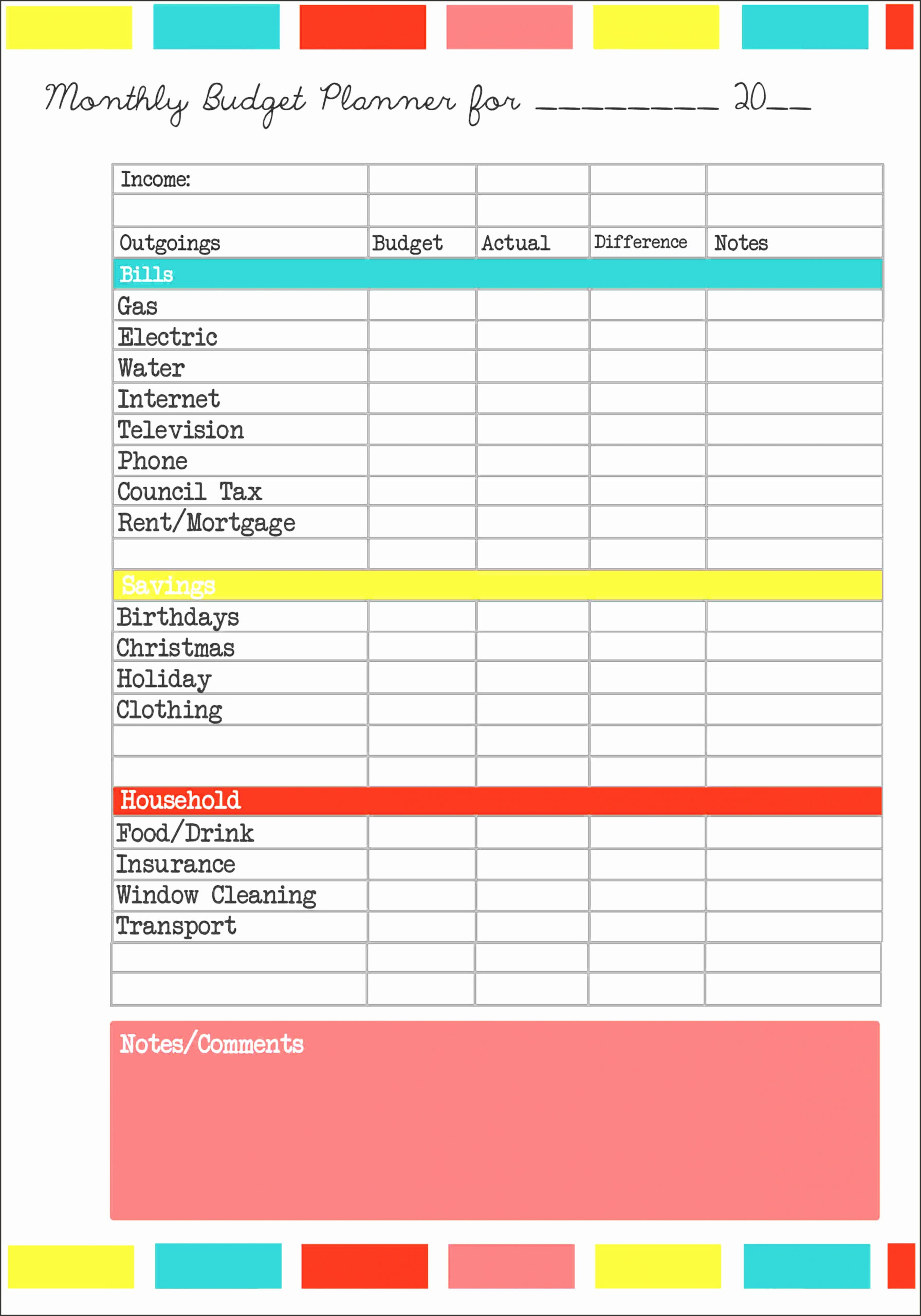

Blank Monthly Budget Worksheet Frugal Fanatic Free Printable Budget

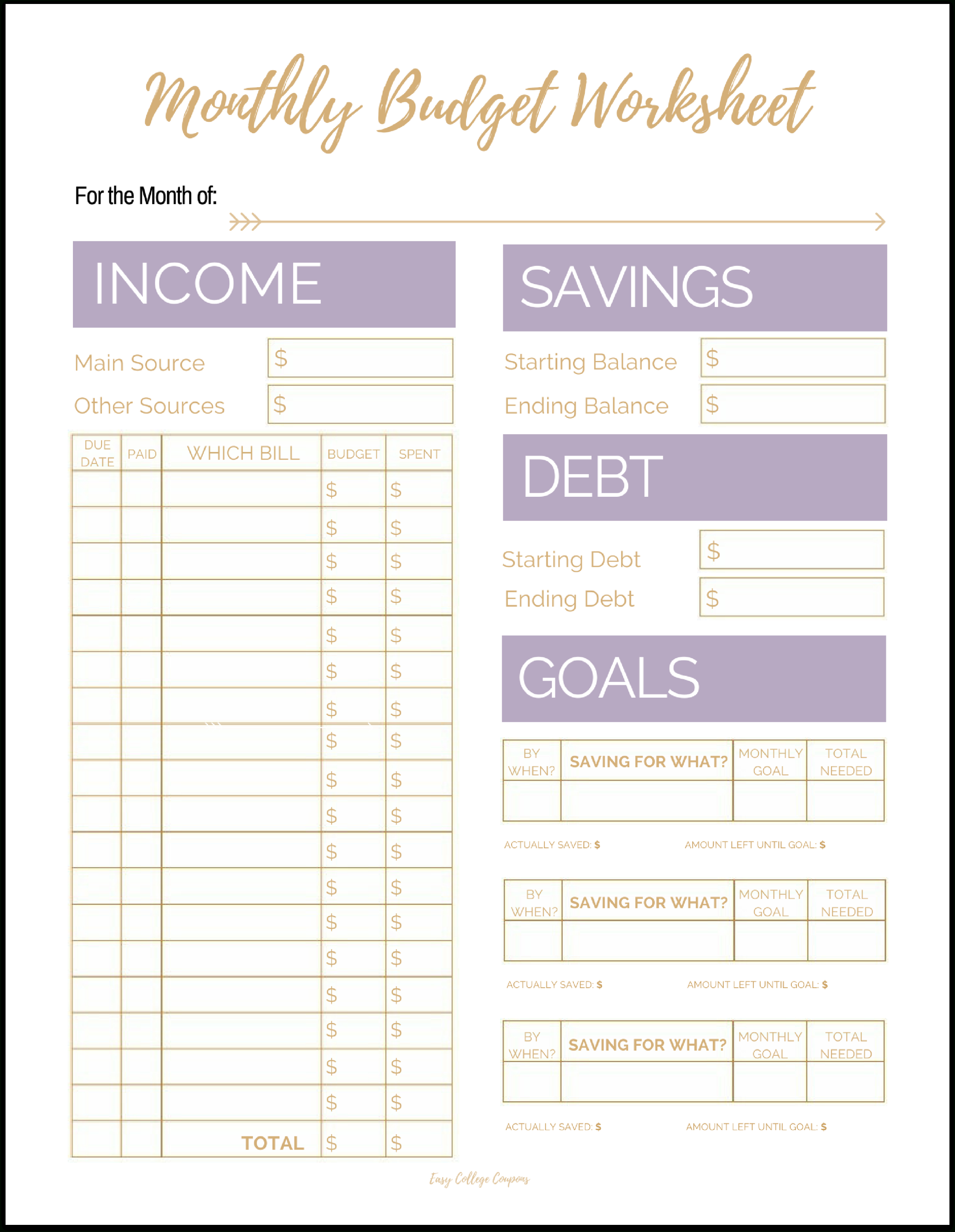

Monthly Budget Planner Form Download FREE Template

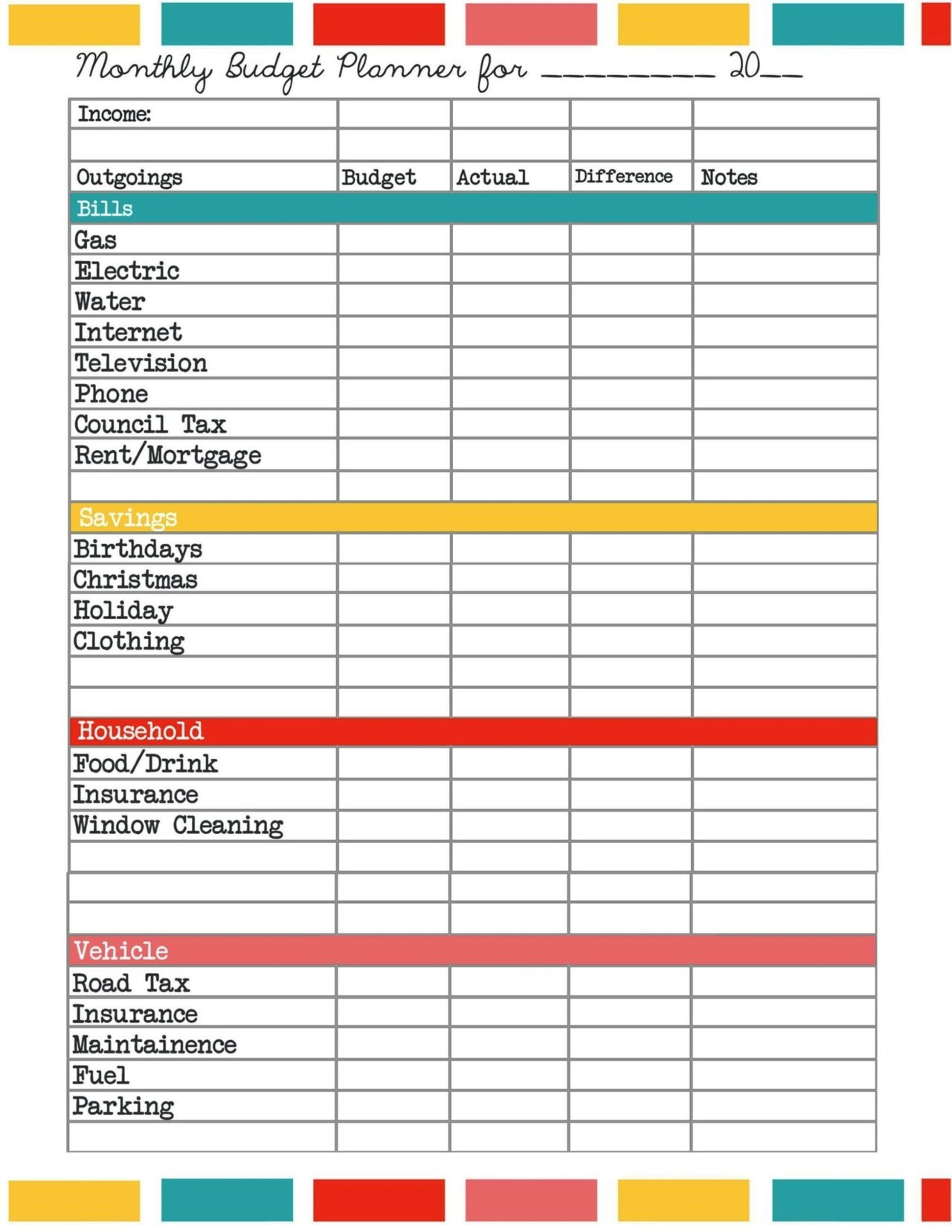

Monthly Budget Planner Template Free Download SampleTemplatess

Budget Planner Worksheet Download

You can locate several offered online if you would certainly like Budget Planner Worksheet Download to use in developing a spending plan. Some internet sites use budgeting worksheets totally free, while others supply even more expensive and intricate tools. Mint is among one of the most popular budgeting apps, and also has cost-free printable budgeting worksheets.

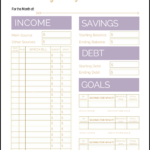

The Frugal Fanatic Worksheet is a simple, clean-looking budget plan that can be printed as well as conserved to aid you prepare your month-to-month costs. Budgeting can be frightening, and a budgeting worksheet can aid maintain you on track. This simple design template permits you to track your cost savings, income, and fixed as well as variable expenses monthly. It likewise includes an area to prepare for your future as well as established goals.

If you’re simply getting started with budgeting, a totally free budgeting worksheet will certainly assist you stay organized as well as on the right track with your funds. Whether you wish to track your expenditures for day-to-day living, special events, or both, these worksheets can assist you make the most of your money as well as avoid of financial obligation.