Budgeting Worksheets | Budgeting For Young Adults – Welcome to your twenties, the perfect time to start mastering money management! As you navigate through this exciting decade of life, it’s important to develop good financial habits that will set you up for success in the future. From budgeting to saving to investing, there are many strategies you can start implementing now to secure a stable financial future. By adopting a thrifty mindset and being intentional with your money, you can make the most of your twenties and set yourself up for financial success in the years to come.

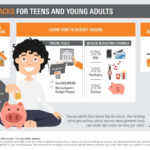

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/money-hacks-for-teens-and-young-adults-retireinvest-se-qld-regarding-budgeting-for-young-adults.jpg” alt=”Money Hacks For Teens And Young Adults – Retireinvest Se Qld regarding Budgeting For Young Adults”]

Money-Savvy Strategies for Your Thrifty Twenties!

One key money-savvy strategy for your thrifty twenties is creating a budget and sticking to it. Take the time to track your income and expenses, and identify areas where you can cut back and save money. By setting clear financial goals and creating a budget that aligns with those goals, you can avoid unnecessary spending and make better choices with your money. Whether it’s cutting back on dining out, finding more affordable housing options, or prioritizing essential expenses, creating a budget will help you stay on track and make the most of your money.

Another important money management strategy for your twenties is building an emergency fund. Life is unpredictable, and having an emergency fund in place can provide you with a financial safety net when unexpected expenses arise. Aim to save at least three to six months’ worth of living expenses in an easily accessible savings account. By building an emergency fund, you can avoid going into debt when faced with unexpected financial challenges and have peace of mind knowing you have a financial cushion to fall back on.

Unlocking the Secrets to Mastering Money Management in Your 20s!

Investing in your twenties may seem daunting, but it’s an important step towards building long-term wealth. Whether you’re considering investing in the stock market, real estate, or retirement accounts, starting early can greatly benefit you in the long run. Take the time to educate yourself about different investment options and seek guidance from financial professionals to make informed decisions. By investing wisely and consistently in your twenties, you can harness the power of compound interest and grow your wealth over time.

In addition to investing, it’s important to prioritize debt repayment in your twenties. Whether it’s student loans, credit card debt, or other forms of debt, develop a plan to pay off your debts as quickly as possible. By reducing your debt burden, you can free up more money to save, invest, and achieve your financial goals. Consider using the snowball or avalanche method to pay off debt, and make regular payments to chip away at your balances. With dedication and discipline, you can become debt-free and set yourself up for financial freedom in the future.

As you navigate through your twenties, remember that mastering money management is a journey, not a destination. Stay committed to your financial goals, be open to learning and adapting, and seek support from friends, family, and financial experts when needed. By implementing money-savvy strategies, building healthy financial habits, and making intentional choices with your money, you can set yourself up for a prosperous future in your thirties and beyond. Embrace your thrifty twenties and take control of your financial future today!

Budgeting For Young Adults

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/free-printables-pertaining-to-budgeting-for-young-adults.jpg” alt=”Free Printables pertaining to Budgeting For Young Adults”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/7-free-teen-budget-worksheets-tools-start-your-teenager-budgeting-regarding-budgeting-for-young-adults.jpg” alt=”7 Free Teen Budget Worksheets & Tools (Start Your Teenager Budgeting) regarding Budgeting For Young Adults”]

“https://budgeting-worksheets.com/wp-content/uploads/2025/09/the-budget-book-for-young-adults-guide-on-budgeting-basics-for-intended-for-budgeting-for-young-adults.jpg” alt=”The Budget Book For Young Adults: Guide On Budgeting Basics For intended for Budgeting For Young Adults”]

Budgeting Worksheets…

Copyright Disclaimer: The rights to all images displayed belong to their original owners. Contact us for attribution or removal if necessary.